If you buy a level term life insurance coverage policy, like Haven Term, the term life rates remain the exact same throughout the regard to your policy, even if it lasts for thirty years. For example, a 35-year-old man in excellent health can get a $500,000, 20-year Haven Term policy, released by MassMutual, by paying a monthly premium of about $23.

That's a distinction of about $108 a year and nearly $1,300 throughout the life of the policy. Your health is another essential aspect that underwriters use to determine your premium. You'll be asked about your health history, your prescriptions, your pre-existing conditions and even your family's medical history when you use.

Underwriters likewise consider things like your occupation and your hobbies. If you're a roofing contractor, anticipate to pay a higher premium than an accounting professional or a college professor. If you go out searching on the weekend, you'll have a greater premium than someone who gathers stamps. When you have your coverage in location, paying premiums ends up being a routine and you probably won't think far more about them.

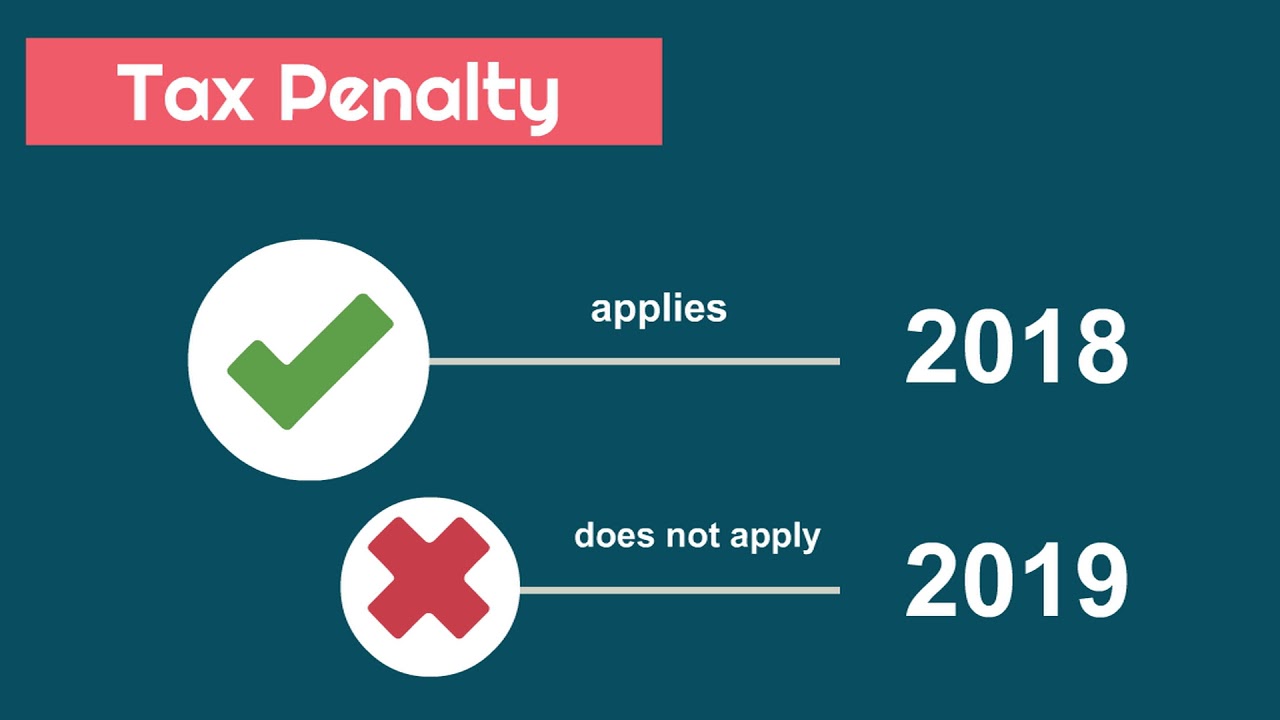

You can deduct your home mortgage interest, your trainee loan interest and your donations to the food pantry on your income taxes, so what about your life insurance coverage premiums? Most of the times, the response is no. But there is great tax news related to life insurance coverage. If you died and your household filed a claim https://gumroad.com/thoinsfih5/p/everything-about-how-to-file-an-insurance-claim-h1-h1-style-clear-both-id-content-section-0-how-how-much-is-the-fine-for-not-having-health-insurance-can-save-you-time-stress-and-money to receive your protection, typically the payment would be tax-free.

With something like fully medically underwritten term life insurance coverage, your premium is custom-built for you based upon the details underwriters have actually collected from your application, medical examination and other databases. And while you can't price bargain for your life insurance coverage premium, you can (and should) search. When you do this, ensure you focus on the scores your life insurance business has actually earned.

Finest or Moody's, then you'll feel less confident about the life insurance business's claims-paying ability. And do not forget there's a lot you can do to get a lower premium before you get to the underwriting phase. Living a healthy way of life for starters, however likewise ensuring you're getting the term length and the coverage quantity that are best for your requirements.

Fascination About What Does No Fault Insurance Mean

This helps life insurers supply a ballpark figure, providing you a concept of what your premiums would be. However, till you go through the underwriting procedure, there's no other way to provide life insurance prices quote that are guaranteed to match your premium. That's because the underwriting procedure might reveal something you didn't understand about your health.

Or perhaps you've had a few speeding tickets in the previous couple years (how long can you stay on your parents insurance). In that case, you're a higher danger to the insurer than your initial details showed, so your premium will be greater. In addition to offering you with a quote, Sanctuary Life makes it easy and convenient to use online significance you can get your real rate anytime, anywhere and from any device.

The premiums you pay become income for your insurance coverage company. Like any company's income, the cash pays for day-to-day operations. Your premiums likewise assist pay claims to the recipients of other policyholders who are going through the grief of losing their loved one. Insurer invest the rest of their earnings from premiums to maximize revenues.

High rankings, such as those of Haven Life's moms and dad company MassMutual, indicate each ranking firm's opinion about the health of their long-term business practices and the probability they'll be around when you need to sue. Do not be shy about looking into these ratings before purchasing your coverage. A life insurance coverage premium is a payment, similar to the home mortgage, the energies, the student loans, and Netflix.

They 'd use an entrance to monetary stability for your liked ones. That is very important stuff, however it does not indicate you need to put your monthly budget at risk by taking on a pricey premium to make it take place. Store around, identify your actual life insurance needs, lock in a term life rate that makes the most of your current youth and excellent health.

Monetary strength rankings for MassMutual are since Might 29, 2019: A.M. Best Business: A++ (Superior; leading category of 15); Fitch Scores: AA+ (Extremely Strong; second category of 21); Moody's Investors Service: Aa3 (High Quality; fourth classification of 21); Standard & Poor's: AA+ (Very Strong, second classification of 21). Ratings are for MassMutual (Springfield, MA 01111) and its subsidiaries, C.M.

Some Known Facts About How Much Does It Cost To Fill A Cavity With Insurance.

and MML Bay State Life Insurance Coverage Co. (Enfield, CT 06082). Ratings go through change. Rankings do not use to Sanctuary Life Insurance Agency.

Ever go to a celebration and, while you're making little talk, somebody arbitrarily states, "Hey, you people you understand what's actually cool? Insurance premiums." Okay, that's most likely never took place since that would be odd. You 'd all look blankly at each other, like, Why is this dude speaking about insurance premiums at a party? If it ever did take place, you 'd smartly excuse yourself and go find a brand-new group of buddies discussing religion or politics.

But, still, a seed would be planted, and after that you would definitely need to know what an insurance premium is. In a nutshell, an insurance premium Click here for more is the payment or installment you agree to pay a company in order to have insurance. You enter into a contract with an insurance provider that ensures payment in case of damage or loss and, for this, you concur to pay them a specific, smaller sized quantity of cash.

So, how do insurance provider create the cost of the premium? Well, initially, people called actuaries work for insurance provider to determine the specific threats connected with a policy - how many americans don't have health insurance. They look at things like how likely a disaster or mishap is, and the probability of a claim being filed, and how much the business will be on the hook for paying out if a claim is submitted.

Now, the underwriter utilizes this data together with details supplied by the individual or business requesting for insurance when they provide a policy to determine what the specific premium will be for the amount of protection they want. While all insurance works in the exact same standard way, in order to keep this conversation from ending up being too abstract, let's look at how insurer determine exceptional amounts for a couple of various kinds of insurance coverage.

The insurer might also take a look at whether you park your car in a garage. Underwriters likewise consider your driving record to see how huge of a threat you are to guarantee. If you have a lot of speeding tickets or you have actually remained in a lot of mishaps, your premiums will be more pricey than those for an individual who does not. Insurers often utilize details from medical claims to get detailed details about the care provided by specific suppliers (a treatment referred to as provider profiling). That information is then utilized to provide feedback to service providers on how their practice patterns compare with those of their peers and to determine providers who are furnishing improper or excessive care (and who might be removed from the strategy's network as a result).

Some Known Questions About How Long Can You Stay On Your Parents Health Insurance.

In many cases, plans Great site likewise use differences in cost-sharing requirements or other strategies to affect customers' options within their authorized networks or variety of covered treatments and services. For example, plans generally establish a drug formulary or list of drugs that the plan covers (which belongs to a company network).

Plans also encourage enrollees to use lower-cost generic variations of drugs when they are readily available, by setting the most affordable copayment amounts for those drugs. More recently, some plans have actually started using the information gathered from provider profiling to designate a chosen "tier" of suppliers based on quality and expense requirements.

In addition, enrollees might be provided financial incentivessuch as lower cost-sharing requirementsto get their care from higher-tier companies. Identifying the results of the different cost-containment tools can be challenging due to the fact that health strategies utilize different mixes of them, and strategies vary along a number of other dimensions. Consequently, much of the released research study has actually focused on comparing HMOs (which have typically utilized more strict cost-containment approaches) with other types of strategies.

In particular, research studies have actually discovered that HMOs minimize using hospital services and other expensive services. Since those studies rely mainly on data that are more than a years old, nevertheless, they probably overstate the differences that exist today between HMOs and other kinds of strategies. On the basis of the available proof, CBO estimates that strategies making more substantial usage of benefit-management methods would have premiums that are 5 percent to 10 percent lower than plans utilizing very little management methods. how much does long term care insurance cost.

Before 1993, healthcare costs normally grew at a much faster rate than gdp. From 1993 to 2000, the share of employees with private health insurance who were enrolled in some kind of managed care strategy increased from 54 percent to 92 percent. During that duration, overall costs for healthcare stayed nearly constant as a share of the economy, at about 13.

Lots of experts think that the growth in handled care plans contributed significantly to the slowdown in the growth of healthcare costs during that period. By the end of the 1990s, opposition to the limitations imposed by managed care strategies was growing amongst consumers and suppliers. The plans reacted by unwinding those limitations, and enrollment moved to more loosely handled PPO plans.

Little Known Facts About What Is A Whole Life Insurance Policy.

0 percent of GDP in 2006. Other elements, nevertheless, have actually unquestionably contributed to the development in health care spending relative to the size of the economy because 2000; hospital mergers ended up being more pervasive, for example, boosting healthcare facilities' leverage in working out with health plans. Proposals to change the medical insurance market or to fund insurance purchases may consist of provisions impacting the management of health insurance.

Although legislators did not enact those proposals, some states embraced similar arrangements restricting health insurance providers that operate in their jurisdiction. (As discussed in Chapter 1, prepares bought in the individual insurance market and a lot of strategies bought by smaller sized employers are subject to state regulations, whereas the bulk of plans offered by larger companies are exempt.) In modeling the effects of such propositions, CBO thinks about the nature of any provisions governing the plan's structure, usage management, and service provider networks and their interaction with existing state requirements.

Under some proposals, insurance companies would be required to cover certain types of care, such as visits to experts, without a recommendation from an enrollee's main care physician. Previous proposals likewise would have approved enrollees rights of redress, enabling those who had been denied protection for a particular service to appeal the choice or pursue other solutions in civil courts.

Other arrangements might likewise regulate insurance companies' networks of providers. Any-willing-provider laws need that health insurance include in their network any supplier who accepts comply with the conditions of the strategy's contract. Many states enacted such laws in the 1990s, however those laws do not apply to employment-based strategies that are exempt from state regulation.

In its previous analyses of propositions to produce a Clients' Bill of Rights in 1999 and 2001, CBO generally determined that much of their provisionswhich are comparable to those explained abovewould increase spending on health care. Because then, however, numerous health insurance have dropped certain cost-containment treatments or changed them with other strategies; to the extent that such modifications were not prepared for, the magnitude of CBO's estimates of the impacts of brand-new proposals that impact plans' management strategies may differ from its previous findings.

For instance, CBO approximated that a federal any-willing-provider law or federal network-adequacy requirements and proposals needing strategies to cover specific kinds of careincluding sees to experts without prior authorization, visits to an emergency room if a "sensible layperson" would have concerned the client's condition as an emergency situation, and the routine costs of enrollment in authorized medical trialswould, in mix, have actually increased private medical insurance premiums by quantities varying from 1.

Some Of How Much Homeowners Insurance Do I Need

7 percent. If reestablished today, nevertheless, similar arrangements would most likely have a smaller influence on premiums; to a level not prepared for in CBO's initial estimates, many health insurance have actually acceded to consumers' preferences for broader access to care by expanding the size of their service provider networks and getting rid of or decreasing some of their limitations on making use of covered services.

For example, the results of propositions to broaden enrollees' access to the courts for pursuing civil solutions to settle disputes with insurance providers would most likely be similar to the impacts that were estimated in 2001 because the expectation in the initial price quotes that the legal environment would not alter considerably has, so far, proved to be precise.

1 percent to 1. 7 percent. Propositions to alter the regulation of insurance marketsas well as many other kinds of proposalscould affect the costs of health insurance by changing the administrative expenses of health plans (sometimes referred to as "administrative load"). In this conversation, administrative expenses describe any expenditures insurance providers incur that are not payments for healthcare services, consisting of the revenues retained by private insurance providers and the taxes paid on those earnings.

( Underwriting includes an assessment of an applicant's health and anticipated usage of healthcare in order to identify what premium to charge.) Expenses related to medical activities consist of expenditures for claims evaluation and processing, medical management (such as usage review, case management, quality guarantee, and regulative compliance), and company and network management (contracting with doctors and healthcare facilities and keeping relations with suppliers).